Changing Class Formations and Changing Television Viewing: The New Middle Class, Television and Pay Television in Brazil and Mexico, 2003‑2013

Abstract

This study will examine how rapidly changing social class structures in Latin America in the last ten years have impacted television viewing. Subscription to cable or pay television has increased enormously in Brazil and Mexico in the last 6-7 years as effects of the substantial growth of the middle class in the last 10-15 years has begun to become very visible in media behavior. Cable television growth in Latin America had trailed far behind most other regions of the world (Reis 1999), where cable and satellite television grew explosively in the 1990s (Balio 1998). Latin America was already covered by well-resourced commercial television stations, which provided a great deal of entertainment, which was closely to tuned to national interests, gaining a great deal of advantage from cultural proximity (Straubhaar 1991). If Latin Americans are now turning to cable or pay television, what has changed?

Keywords

Television, cable, pay-TV, consumption, practices, Latin America, Brazil, Mexico.

En Français

Titre

La formation des classes et des pratiques de consommation de la télévision en changement : la nouvelle classe moyenne, la télévision et la télévision payante au Brésil et au Mexique, 2003–2013

Résumé

Cette recherche analyse la rapidité avec laquelle les structures de classe ont participé au changement des pratiques de consommation de la télévision en Amérique Latine lors de cette dernière décennie. L’abonnement au câble ou télévision payante s’est fortement développé au Brésil et au Mexique ces 6 à 7 dernières années et les effets de la croissance de la classe moyenne lors des 10 à 15 dernières années se révèlent. La hausse des abonnements au câble en Amérique Latine arrive après celle des autres régions du monde (Reis, 1999), où la télévision par câble et par satellite s’est développée dans les années 90 (Balio, 1998). L’Amérique Latine disposait d’un grand nombre de chaînes de télévision privées qui assuraient du divertissement en lien étroit avec les intérêts nationaux, et bénéficiant d’une proximité culturelle (Straubhaar, 2001). Qu’est-ce qui a changé n Amérique Latine pour que les populations se tournent vers le câble et la télévision payante ?

Mots clés

Télévision, câble, payant, consommation, pratiques, Amérique Latine, Brésil, Mexique.

En Español

Título

Formaciones de classe y el consumo de television en cambio: La nueva classe media baja, television y television paga en Brasil y Mexico, 2003–2013

Resumen

Este análisis examinará como las estructuras de clase social en América Latina están cambiando e como este cambio está afectando el consumo de televisión. Televisión de pago tiene crecido rápidamente en los últimos 6-7 años conectado al crecimiento rápido de la clase media. Antes el crecimiento del pose de televisión de pago se quedó mucho atrás de varias otras naciones en el mundo (Reis 1999), donde la televisión de cable y satélite creció explosivamente en los años 90 (Balio 1998). Una razón fue que América Latina ja tiene desarrollada un numero notable de redes y estaciones de televisión comercial, que ja providenció mucho entretenimiento, muy conectado a las culturas nacionales y regionales, ligado a un censo de proximidad cultural (1991). Si los Latinoamericanos están se orientando mas ahora a la televisión de pago, por que?

Palabras clave

Televisión, de pago, de cable, consumo, prácticas, Brasil, México.

Pour citer cet article, utiliser la référence suivante :

Straubhaar Joseph D., Sinta Vinicio, Spence Jeremiah, Higgins Joyce Vanessa de Macedo, «Changing Class Formations and Changing Television Viewing: The New Middle Class, Television and Pay Television in Brazil and Mexico, 2003‑2013», Les Enjeux de l’Information et de la Communication, n°17/2, 2016, p.207 à 223, consulté le , [en ligne] URL : https://lesenjeux.univ-grenoble-alpes.fr/2016/dossier/14-changing-class-formations-and-changing-television-viewing-the-new-middle-class-television-and-pay-television-in-brazil-and-mexico-2003‑2013/

Social class and television in Latin America

Social class has long been considered crucial to what happens with television viewing in Latin America. Even though most Latin American countries had one or two dominant broadcast television networks that monopolized most viewing across social classes from the 1960s through the 1980s (Sinclair and Straubhaar 2013), that had begun to change by the 1990s.

In Brazil, although TV Globo continued to dominate ratings, often still getting audience shares above 50%, SBT began to make inroads in the audience by targeting the lower middle class and working class, whose tastes had been somewhat neglected by TV Globo (Borelli and Priolli 2000). SBT focused on genres that had been deliberately been downplayed by TV Globo in its drive for higher quality programming (Sinclair and Straubhaar 2013). Those included reality shows, such as Aqui Agora (Here and Now) (Mayer 2006), and live variety shows, which were the particular forte of SBT founder Silvio Santos, who had hosted such shows successfully on other networks before getting licenses for his own network in 1981 (Mattos 2002). Another network, TV Record, bought in the 1990s by a Brazilian Pentecostal church, the Universal Church of the Reign of God, took a similar programming line, also with some audience success. Both these networks showed that there was potential for segmented television in Brazil, particularly if the segmentation of the audience was focused on social class.

In Mexico, both commercial broadcasters with national coverage -Televisa and Televisión Azteca- have largely stuck to the « populist »(1) entertainment formula perfected by the former from during its years as the only television company in the country. The entry of Televisión Azteca in 1993, however, brought with it some limited attempts at differentiated targeting. During its first decade, Azteca based its domestic fiction offering on telenovelas produced by the production company Argos. The telenovelas produced by Argos featured elements that were unimaginable in the « fairy-tale-like » stories that characterized Televisa, such as portrayals of political corruption, antihero protagonists and comparatively liberal portrayals of gender relations (Casas 2005; Gutiérrez 2007). Some evidence suggests that these features are more appealing to more educated viewers (Casas 2005), which in Mexico cluster in the upper socioeconomic strata. After finalizing its partnership with Azteca in 2000, Argos moved on to produce content for the U.S.-based Telemundo network and for pay television channels, including premium outlets such as HBO (Hecht 2007; Piñón 2014). As of 2014, Argos productions are presented in Cadenatres, a Mexico City-based broadcast television channel that targets middle and upper-middle class audiences (Grupo Empresarial Ángeles n.d.).

As in much of the rest of the world, global television networks and operators in both Brazil and Mexico took advantage of satellite delivery technology, both direct to home and to cable TV systems, to try greater expansion in the 1990s (Duarte 2001). The initial take up of this kind of segmented pay television was strongest among elites and the upper middle class, as noted by Duarte (2001) and also as visible in the data for this study, reported below.

The growth of the middle class in Latin America

Emerging middle classes in Latin America have garnered considerable attention in recent years. A recent World Bank report indicates members of what it considers middle classes now outnumber the poor in Latin America and the Caribbean. (Ferreira et al., 2012) Economic mobility in the region is improving greatly as formerly impoverished members of society increasingly find stable income in the formal employment sector. Applying Sen’s capability approach (Nussbaum, 2011; Sen, 1995), Lopez-Calva and Ortiz-Juarez (2014) define the middle class in Latin America as the group of individuals who face little risk of sinking into poverty. As the formal economy in Latin America expands, more people enjoy a stable income, rather than see their incomes in informal employment rise and fall. This newly stable income affords members social mobility and the ability to establish more consumer-oriented lifestyles, (Ferreira et al., 2012) which may include increased TV viewership, or movement toward getting pay television. The World Bank defines middle classes in Latin America as persons with a per-capita daily income of $10-$50 purchasing power parity, which Lopez-Calva and Ortiz-Juarez (2014) say is enough to stabilize households enough to keep them from slipping into poverty.

Much of the discussion regarding current media developments, in both television and digital media, in Latin America, particularly Brazil and Mexico, is about the emergence of a new lower middle class, which has been estimated at over 40 million people in Brazil (Zizola 2014), and about 22.5 million in Mexico (2). However, the World Bank also cautions that the poorest, least educated and least well connected of the new lower middle class may have a somewhat tenuous grip on their middle class status, and could slip back into poverty more easily than better established parts of the middle class.

The current economic status of the new lower middle class does enable them to have considerable new purchasing power, but they may not have as much education, cultural capital or social capital as previous middle classes (Bourdieu 1986). That is still true even though education levels among the working poor, working class and new middle class are rising, due to programs like the Bolsa Escolar (school scholarship) and Progresa/Oportunidades (progress/opportunities), in both countries, which pay poor parents to keep their children in school rather than having them work to help support their families (Soares, Osório et al. 2007).

Although the World Bank and like-minded researchers define middle classes in terms of income, the idea of the middle class connotes other social factors such as education (Bourdieu, 1984; Bourdieu & Passeron, 1977) or political participation. (Habermas, 1991) Although Ferreira et al. (2012) note that income is only one of many factors in class formation, their operationalization of these emerging middle classes in largely economic terms may ignore factors which may contribute to cultural practices such as watching TV. Bourdieu’s account of class using the concepts of disposition, habitus, and multiple forms of capital, including cultural capital, (Bourdieu, 1984; Bourdieu & Passeron, 1977; Bourdieu & Wacquant, 1992; Calhoun, 1993; Garnham, 1993) may provide greater insight into why some segments of Brazilian or Mexican society are turning to multichannel television for information and entertainment.

Although we cannot ignore the material basis of increased television viewership, which does permit greater numbers to afford sets, better sets, and now more recently, cable or pay television, greater spending power may lead to more positive dispositions toward consumption both from the entertainment value of television and from the symbolic capital television ownership provides. According to Bourdieu (1986), symbolic capital results from the possession of goods, acquired characteristics (like education) or qualities that are considered desirable or positive by society, that give increased status. The possession of a television, or cable television is a status marker in these societies, signaling class mobility for newly stable households. One of the first societies in Latin America to have cable television was the Dominican Republic, which began pirating it from U.S. satellites as early as 1985. Interviewing Dominicans in their homes about television use in 1986-88, Straubhaar noted that many homes had a visible cable wire coming in the window, but did not watch much from it. They lacked the cultural or linguistic capital to understand the programming, which being pirated, was all in English, but having it visibly entering their homes and having the cable box on top of their television granted considerable prestige, which was worth the expenditure for many (Straubhaar, field notes, August 12- December 12, 1987).

Cultural capital is directly linked to education. Cultural capital can be learned from parents, from peers, from work, but tends to heavily linked to things learned in formal or informal education (Bourdieu, 1984). Because of the role that education plays in producing and reproducing class status and tastes, this study will also investigate the potential role of education in subscribing to multichannel TV services.

Cultural capital also is notable because it is capable of moving Latin American audiences away from a tradition of preference for and loyalty to nationally-produced programs, such as telenovelas, which have long dominanted the television landscapes and viewer preferences of Latin America, since at least the 1970s (Straubhaar 1982). In Latin American countries, which were too small or poor to produce expensive shows like telenovelas, viewers tended to prefer shows from other countries in the region (Antola, Rogers et al. 1984, Rogers and Antola 1985). Those viewer preferences have been theorized as driven by cultural proximity, an audience tendency to prefer cultural products that are as similar to one’s own culture as possible, or from very similar cultures (Straubhaar 1991). However, from this original theorization of cultural proximity on forward, studies have observed that cultural proximity can be modified or even contravened by cultural capital. Straubhaar’s (1991) study of Brazil and the Dominican Republic noted two surveys that showed that upper class people, particularly as defined by education rather than just income, were more likely to prefer foreign television programs than were people of the middle, lower middle and working classes. Subsequent indepth interviewing suggested that the critical formative elements of cultural capital that might lead viewers to prefer foreign programs or channels included not only education, per se; but also learning other language, particularly English; travel and study abroad; and working with people from other countries (Straubhaar 2007). Still, education is strongly related to all these things and will serve as a good indicator of cultural capital and its impact on national vs. international viewing preferences, strongly related, we argue to the decision to pay for multichannel television, which in Latin America, has been largely dominanted by imported channels.

A brief trajectory of pay-TV in Brazil and Mexico

In just a few decades, subscription-based television services in Brazil and Mexico grew from utilitarian beginnings as distributors of domestic broadcasters’ contents to isolated regions far from the major urban centers (Crovi 1999; Possebon 2008) to becoming the epicenter of intense competition by the regions’ major players in the age of ICT convergence and more stringent regulations (Gómez & Sosa 2010; Crovi 2006; Matos 2012).

In both countries, the entry of pay television was characterized by a slow, gradual start, concentrated in a few select markets ‑the US border area in Mexico(3), and scattered urban areas in Brazil‑ followed by a maturation process that started with the entry of media giants Televisa in Mexico, TV Globo and publishing house Editora Abril in Brazil (Crovi 1999; Possebon 2009). Throughout the 1990s, the Brazilian and Mexican pay-TV markets went through a maturation process characterized by the direct participation of international providers such as DirecTV and Sky, first as competitors, then as partners with the local companies. This stage also led to the incursion of foreign -mostly American- media companies, which launched culturally proximate Latin American versions of properties such as the Discovery Channel, HBO and MTV (Duarte 2001).

It was during the DTH TV revolution that Televisa and Globo’s ventures into pay television became intertwined. Both companies, in a partnership with Rupert Murdoch’s News Corporation, participated in the establishment of Sky México and Sky Brazil, the first direct-to-home (DTH) satellite service in their respective countries. After almost two decades of accelerated growth, DTH television services now account for a plurality of pay television subscriptions in both Brazil and Mexico, according to figures from regulatory agencies in both countries (ABTA 2014; Instituto Federal de Telecomunicaciones 2014). Telecommunications industry researchers forecast that this service will continue to drive the growth of pay-TV in the region in the short term (Murray 2014).

In the last ten years, Televisa has consolidated its dominion of the Mexican pay television field by acquiring several of the largest regional cable companies (Harrison 2013; Villamil 2011; Palavecino 2011), and establishing informal alliances with the largest remaining independent cable operator Megacable (El Financiero 2014). At the same time, the company continues to be the main owner of Sky México, which operated as the only DTH TV service in the country for four years after Galaxy Latin America’s DirecTV pulled out of the country in 2004 (Gómez & Sosa 2010; Villamil 2011).

In 2008, a joint venture of the American companies Dish and Echostar with the Mexican Grupo MVS launched Dish Mexico, which broke Sky’s monopoly over the direct-to-home market in Mexico. The service, which targeted lower-income consumers with budget-priced basic packages, reached more than half a million subscribers by mid-2009 and triggered a reduction of prices on the part of the Televisa-owned CATV operators(4) (Gómez & Sosa 2010).

In Brazil, a major shock for the pay television industry occurred in 2012, when Embratel, a property of the Mexican telecommunications juggernaut América Móvil, took over Net Brasil, which formerly was Globo’s largest pay television service in terms of the amount of subscribers. This acquisition turned América Móvil into the largest pay-TV operator in Brazil -and all of Latin America- almost overnight (TeleGeography 2012), despite the fact that Mexican law bars the company from operating television services in its home country. In a notably parallel move, Editora Abril sold its cable assets in 2011 to Telefónica of Spain.

Even after losing Net Brasil, Grupo Globo continues to play a visible role in the Brazilian pay television service industry as a minority partner in the Sky/DirecTV alliance, which in 2014 still had the second largest share of pay TV subscribers in the country (ABTA 2014). TVA sold its satellite operations to DirecTV, which then merged with Sky Latin America.

Research Questions

RQ 1: We expect to find that use of multichannel or pay-TV began to grow more rapidly in the late 2000s or early 2010s as incomes grew in Brazil and Mexico. This is because incomes grew more rapidly starting in the late 2000s and a certain level of disposable income or economic capital is required to let people in developing countries consider the extra cost of pay TV.

RQ2: However, we expect to find that the growth in usage of multichannel or pay-TV in Brazil and Mexico is even more closely connected to education than to income. This is because cultural capital is even more important to a preference for multichannel or pay TV than is economic capital, per se, because cultural capital is linked to the preference for more outside or imported culture via television.

RQ3: If we break down the association between getting multichannel or pay TV, and income and education one step further, to see what reasons people give for getting multichannel television, we would expect to see some reasons more associated with income and others more associated with education. For example, since wealthy people are often seen as wanting the latest in technological gadgets, very visible in publications like Wired magazine, we might expect income to be more associated with wanting “to be up to date with the latest technology,” since having the economic wherewithal to opt for new technology, per se, makes quite a bit of sense. It may be also be true that people of higher education want the latest in technology, per se, too, although wealth will make acquiring them easier. We would expect “to have better reception” to be more associated with income, especially among the poorest, since broadcast reception on the peripheries of large metropolitan areas, where the poor live, has been spotty, leading some to get large, old fashioned C band satellite antennas simply to get signals for national networks (Sinclair and Straubhaar, 2013). More central to our concerns about cultural capital and economic capital, we would expect education to be somewhat more associated than income with both the desire “to have more television channels” and “to receive entertainment and information from other places.” Theoretically, in terms of cultural capital and cultural proximity (Straubhaar 1991; 2007), education (representing cultural capital) should be more associated with a preference for more non-broadcast channels, especially more foreign channels, than income.

Sample and methods

This study makes a secondary analysis of data from the TGI Latina survey, a media and product consumption study conducted yearly in eight Latin American countries by the Miami-based marketing intelligence firm Kantar Media, with fieldwork by IBOPE (Instituto Brasileiro de Opinião Pública e Estatística). Straubhaar was offered this data in return for doing a book length analysis of television trends 2004-2014 for Kantar Media and DirecTV Latin America, which formed a consortium to work with us on this project. That limited circulation industry book is now being turned into an academic book for Palgrave Books (forthcoming).

Using this type of data presents significant challenges to researchers since it emphasized principle cities and major metropolitan areas attractive to marketers and is not a general public sample. It was not collected with the research questions in mind, but does have data that permit us to answer most of our primary questions. The availability of this data affords the research team with an opportunity to better understand emerging class formations and their television viewing without engaging in the expense of a broad multinational survey. Moreover, cities may play an important role in the formation of what the World Bank (2012) terms new middle classes thanks to their larger spheres of formal employment and opportunities for consumption.

While this study may ignore new segments in rural areas or smaller cities with greater purchasing power and access to media, thanks to the method of data collection, its results should be indicative of social phenomena in the major metropolitan areas in Latin America, which represent 60-80% of the populations of these countries. Moreover, it reflects the agenda of international marketers who would be using TV results for advertising purposes, so it is likely a good indication of who is using cable or other multichannel systems for TV programming.

For researchers interested in issues of social stratification, using market-research data may provide an opportunity to examine populations too difficult or expensive to survey. The survey used for this study was conducted door-to-door with a combination of interviews and a paper survey left behind by the interviewer. In Brazil, in 2013, interviewers surveyed 31,113 individuals about their own and their household’s spending habits. In Mexico, 16,232 individuals responded to the survey. Interviewers followed a skip pattern for sampling that was based on the physical location of respondents’ homes. Since response rates were low among some important demographic groups – particularly high SES households – TGI Latina weighted the responses to better represent the overall population. Although the 2013 sample was the largest, all the samples for the various years were very large, over 10,000. All of the cross-tabs we created for the analysis were significant at the P >.001 level, utilizing the Chi Square, but we run some risk of Type One error here, finding everything significant just because the sample is so large, which is a particular danger for the Chi-square.

To address developments in class formations and television viewing over time, the surveys from previous years used in this study have a similar number of respondents and used the same sampling method. The research team used only a small subset of the survey items for this study. While the survey makes extensive queries about the respondents’ consumption habits – including asking about specific brands of food and beverage – this study limited its analysis to the variables related to TV service in the homes of respondents.

Measurements

For the purposes of this study, three variables were adapted from TGI Latina data collected in Brazil and Mexico during 2003, 2007, 2011 and 2014: Multichannel penetration, Income/Socioeconomic status and Education.

Multichannel penetration

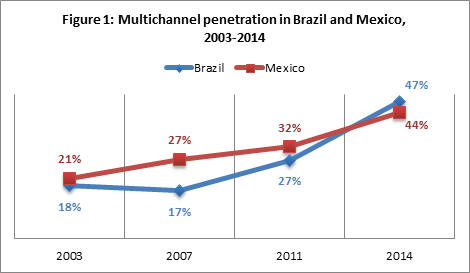

Figure 1. Change s in Multichannel TV penetration in Brazil and Mexico, 2003-2014

Respondents were asked whether they had access to cable, satellite and/or microwave (MMDS) television services. For this study, usage of any of the three services was counted for an estimation of Multichannel TV penetration.

Income/Socioeconomic status

To control for the differing economic contexts of the eight countries covered by its study, the TGI Latina survey uses a definition of socioeconomic status that places respondents into one of four strata -Top 10%, Next 20%, Next 30% and Bottom 40%- by assigning them a score based on six factors, including: (1) Employment situation of head of household, (2) Business-related decision expenditures, (3) Educational achievement of head of household (two items), (4) Telephone ownership, (5) Employment of domestic help and (6) Household goods ownership (ten items).

While this composite measure does not allow for the identification of precise cutoff points for lower-middle and middle classes in Brazil and Mexico, for the purposes of this study the two lowest SES groups -the Next 30% and Bottom 40%- will be used as proxies for the lower, lower-middle and middle income groups in both countries.

Education

Respondents were classified in one of five categories of educational achievement depending on the last level of education reached: Primary (equivalent to elementary); Secondary (equivalent to middle school); Tertiary (equivalent to high school, as well as commercial/technical training); University, and Postgraduate.

Results

Socioeconomic Status, Education, Income and Multichannel Penetration

RQ1 asks whether the pay-TV penetration rates in Mexico and Brazil accelerated their growth in the second half of the period spanning 2003 through 2014, a decade identified by economists as an era of expansion for the middle and lower-middle socioeconomic strata in Latin America. According to time series data for both countries, that appears to be the case. Through the four time points (2003, 2007, 2011 and 2014), both countries show an initially stagnant growth in multichannel penetration -in fact, there was a slight decrease among the highest SES group from 2003 to 2007- followed by generalized gains from 2007 to 2011, and finally a stronger expansion from 2011 to 2014.

The two lower income groups, which include both the « new » lower-middle (or vulnerable) class as well as those under the poverty line, show the strongest growth throughout the period. In Brazil in particular, between 2011 and 2014 the rate of pay television usage among income groups representing the « next 30% » and « next 40% » income groups grew more than 100% – from 23% to 47% and 8% to 20%, respectively. During the same period, the lowest income group in Mexico -the bottom 40%- also showed dramatic increase in its pay-TV penetration rate, which went from from 13% to 27%.

It’s worth mentioning that in both countries, the SES group referred to as the « next 30% » -those less affluent that the two top strata, but who still have a stronger purchasing power than the poorest 40% of the population- are as of 2014 approaching a pay-TV penetration rate of 50%.

Figure 2. Changes in Multichannel TV penetration by Income level in Brazil and Mexico, 2003-2014

Figure 3. Changes in Multichannel TV penetration by income level in Mexico, 2003-2014

Education and Multichannel Penetration

RQ2 asks about the trends in multichannel adoption according to respondents’ education achievement. The trends are similar to those observed in the analysis based on SES: slow growth or a slight decrease in the first two time points, followed by a faster penetration growth in 2011 and 2014.

The accelerated adoption of pay-TV among respondents with a lower education achievement is particularly pronounced. For example, in Brazil, multichannel television was present in the homes of just 8% of those who studied up to primary school and 18% of those who just finished secondary school in 2003; by 2014, these groups’ penetration rates had reached 32% and 48%, respectively.

Figure 4. Changes in Multichannel TV penetration by Education level (Graduate school,

university, post secondary, secondary, and elementary) in Brazil and Mexico, 2003-2014

Figure 5. Changes in multichannel penetration by education achievement, Mexico, 2003-2014.

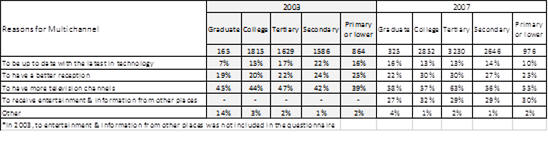

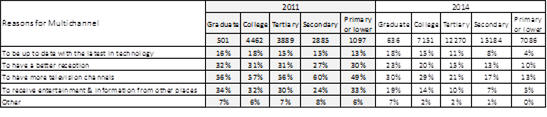

Education, Income and Reasons for Getting Multichannel Television

There are a number of reasons why a person or household might decide to pay for multichannel television, even though its costs, historically, have been fairly high. These reasons, when compared and broken down by income/purchasing power and education, can help us understand the differences in impact between economic and cultural capital, in this fundamental decision, which gives people access to many channels produced beyond their nations or even the region of Latin America.

One possible reason is “to be up to date with the latest in technology.” This was not one of the main reasons, but it was given by 5-20%of people from 2003 to 2014 in both Brazil and Mexico, although it was somewhat more prevalent in Brazil. It was also somewhat more common among high levels of income and education, presumably because they can afford to take up a new technology because it is new or fashionable.

The response “to have a better [quality of] reception” was a major reason among most people. People of lower income and education gave this response most often in 2003. For example, in Brazil in 2003, 60% of the poorest respondents gave this response, compared to 33% of the richest 10%. In the same year, the least educated gave this response 43% of the time, compared to 37% of the most educated. So this issue in 2003 seemed to be more important to the poorest who are probably also those who live in poor, peripheral areas on the outside of cities where reception is worst. This obviously overlapped the least educated, too, but income presented a clearer, more significant connection.

Interestingly, in 2007-2011, the differences between groups declined. But the issue of getting better reception through cable or satellite TV became clearly more important in Brazil than in Mexico. The averages in 2007 were 41% in Brazil and 28% in Mexico. In 2011 the averages were 30% in Mexico and 47% in Brazil. Interestingly, by 2014, in Mexico, the salience of a good signal declined even more in Mexico, to an average of 15%, However in Brazil the issue remained high for the wealthier and better educated (both over 45%), but declined under 20% for the poorest and least educated. So it seems that getting an adequate signal of existing channels must have improved for the poorer, more peripheral parts of major Brazilian cities.

The next possible reason for paying for multichannel TV, asked in the TGI survey, was “to have more television channels.” In 2003, better educated Brazilians were more likely to give this as a reason (over 60%) than less educated Brazilians (under 55%). Education was more associated with wanting more channels than was income. It was a less important reason for Mexican viewers in 2003, and education was quite similar to income, in terms of their association with having multichannel TV. In 2007, the association of wanting more channels went up in Brazil for both higher education and higher income. In Mexico, all groups were more likely to say they wanted multichannel TV to have more channels. In 2011, that was reversed, with the only groups saying they were less interested in more channels being both lower education and lower income groups in Mexico. By 2014, there was a dramatic decline among all groups in saying that having more channels was a reason to get pay TV, except among the best educated and richest Brazilians. In both Brazil and Mexico, that might have to do with a notably cooled off economy in 2014, making people more conservative in their expenditures, particularly those is the lowest income groups.

The reason most relevant in our study was to get “entertainment and education from other places,” since that probably measures a preference for foreign rather than domestic channels. In Brazil, in 2003, this reason was put forth by those with at least a high school education more frequently than by those with less. The association with income was even more interesting, it was high (57%) among the richest 10% and declined gradually to a much lower number (27%) among the poorest 40%. Unfortunately, the question was not asked that year in Mexico. A very similar pattern showed up in Brazil in 2007, but in Mexico there was very little difference between education and income groups in giving this reason for pay-TV. A similar yet more specific pattern can be drawn from Brazil’s 2011 statistics, groups with higher rates of income and education gave that reason more often than other groups, while differences between groups in Mexico were a bit larger according to highest and lowest education and income groups. Finally, in 2014, all the groups were less likely to give this as a reason for wanting pay-TV, perhaps because of the economic cooling noted above. Nevertheless, the best educated and highest income groups were notably more likely to give this as a reason than were lower income and education groups.

Analysis and conclusion

We found substantial confirmation for the anticipated direction of our first research question, that growth in income among the lower middle class would be strongly associated with growth in multichannel or pay-TV. The two lower income groups, which include both the « new » lower-middle (or vulnerable) class as well as those under the poverty line, show the strongest growth in multichannel or pay-TV use throughout the period. In Brazil in particular, between 2011 and 2014 the rate of pay television usage among the « next 30% » and « next 40% » income groups grew more than 100%. During the same period, the lowest income group in Mexico -the bottom 40%- also showed dramatic increase in its pay-TV penetration rate, which went from 13% to 27%.

This tends to confirm our implicit hypothesis that strong growth in income in the lower middle class, essentially constituting a new lower middle class, as observed by the World Bank and other studies cited above, would be associated with growth in pay or multichannel TV, which has been seen as something of a luxury for such people until the late 2000s, or early 2010s.

In our second research question, we anticipated that education might be even more strongly associated with the growth of pay or multichannel television. That is because education is more directly associated with cultural capital, which in some historical studies of Latin American audiences has been associated with a preference for foreign versus national television (Straubhaar 1991). Historically, pay TV was associated with the importation of foreign channels, but that has been changing since the late 2000s, as both Televisa and TV Globo have been screening an increasing number of their own channels on pay or multichannel TV systems. Outside providers like DISH have also been offering low cost packages that include more national channels to attract poorer subscribers. That would reverse this expectation somewhat, by giving the least educated more domestic channels that they would have an easier time relating to (Straubhaar 2007). We found this latter expectation confirmed in the accelerated adoption of pay-TV among respondents with a lower education achievement after 2011.

In terms of our third research question, perhaps our most important expectation, overall, was that people from higher levels of education would more often say that they got pay TV to get “entertainment and education from other places,” since that probably most closely measures a preference for foreign versus domestic channels. Theoretically that would be because education is more directly associated with cultural capital, which in some historical studies of Latin American audiences has been linked with a preference for foreign versus national television, whilst middle class, lower middle class and working class audiences have tended to prefer national programming, theoretically from a sense of cultural proximity (Straubhaar 1991; 2007). We found this in some years, but overall education and income both tended to be associated with this preference for “entertainment and education from other places.”

That indicates that both economic capital and cultural capital are associated with the reason for getting pay TV. Clearly, from Bourdieu’s (1984) initial theorization on the economic and cultural capital are often closely related, those with great income usually tend to have higher education as well. Those with greater income are more likely to be able to arrange high level education for themselves and their children, although one of the avenues of social mobility that Bourdieu anticipates is the accumulation of cultural capital through education, which can be converted into economic capital by obtaining higher paying work with a higher level of education, particularly at the university level. So although we had expected a clearer, larger association between wanting foreign contents and cultural contents than between foreign TV preferences and economic capital, that was not clearly supported overall. We had thought that between the logic of education or cultural capital leading to greater knowledge of world cultures would be more significantly linked to wanting pay-TV than the logic of more people being able to afford more access to foreign culture in the form of pay-TV. But since the two forms of capital, cultural and economic, are closely linked in both theory and social life, maybe this result is not surprising after all. So the next task may be to do both more empirical and theoretical work to better understand the relations between cultural capital, economic capital, cultural proximity, and the converse desire for more foreign content.

Our next issue was related to the above in theoretical terms. That was whether education would also be more associated with wanting more channels, per se, than was income. Theoretically that would again be because education is more directly associated with cultural capital, which has historically been linked to having a preference for more channels beyond the national broadcast channels. Historically, those channels came from outside the nation, even outside the region, from the USA, Japan and Europe. However, as noted above, recently both Televisa in Mexico and TV Globo in Brazil have started creating their own cable channels, which muddies this picture somewhat. So in 2014, it is quite possible to imagine that someone wanting more channels would hope for the extra national channels that can now be found on multichannel or pay TV in both countries.

We found this pattern of connection between wanting more channels and education in 2003, before the rapid growth in incomes that lifted many out of the working class into the middle class in both countries, particularly Brazil. So in 2003, when incomes for the lower middle class had not yet grown, education was logically a better predictor.

After that, however, things proceeded to get more complex. By 2007, most groups except the least educated and least well off wanted more channels, which may already have been influenced by rising incomes that made it easier for people to realistically desire more channels to choose from. By 2014, this reason for pay TV had declined among everyone except the best educated Brazilians. So overall, there is still some positive association with higher income and education, and wanting more channels, as well as a lower level of interest among those with the least education and income.

The response “to have a better [quality of] reception” was a major reason to get pay TV among most people, particularly in Brazil, in 2003. Initially, people of lower income and education gave this response most often, but that changed over the years. For most people, this became a steadily less important reason to get pay TV, especially in Mexico, perhaps as conditions of reception for regular television improved in major metropolitan areas.

Keeping up with the newest technology is less commonly cited as a reason for getting pay TV, but was common enough, around 15-20% overall. It was somewhat more common among the better-off, which makes sense since they will likely have the economic surplus to go for new technologies simply because they are new, and fashionable.

Tables

Table 1A: Reason for Multichannel in Brazil by Income Level (2003 and 2007)

Table 1B: Reason for Multichannel in Brazil by Income Level (2011 and 2014)

Table 2A: Reason for Multichannel in Mexico by Income Level (2003 and 2007)

Table 2B: Reason for Multichannel in Mexico by Income Level (2011 and 2014)

Table 3A: Reason for Multichannel in Brazil by Education (2003 and 2007)

Table 3B: Reason for Multichannel in Brazil by Education (2011 and 2014)

Table 4A: Reason for Multichannel in Mexico by Education (2003 and 2007)

Table 4B: Reason for Multichannel in Mexico by Education (2011 and 2014)

Notes

(1) A famous quote attributed to Emilio Azcárraga Milmo, CEO of Televisa from 1973 until his death in 1997, was that the company made television for the « popular » and « modest » middle class (trans. « clase media popular »), which he contrasted to the « exquisite » class (« la clase exquisita »). (Fernández & Paxman 2000).

(2) This number is based on the 20% estimation proposed by the Mexican Secretariat of Economy in the text of the National Program for the Protection of Consumer Rights (Diario Oficial de la Federación 2014).

(3) The first cable provider in Mexico was established in 1954 in the city of Nogales, Sonora, where it provided American programming to U.S. citizens living south of the border with Arizona (Crovi 1999; Sánchez Ruiz 1991). Pay television did not reach a major metropolitan area until the first cable license was granted to a Monterrey-based company in 1964.

(4) In 2009, Cablevisión, TVI/Cablevisión Monterrey, Cablemás and Megacable launched a budget triple play package called « Yoo », priced at $499 MXN (around $37 USD in 2014). With the exception of Megacable, all of the initial partners in this venture are owned by Televisa (Gómez & Sosa 2010).

References

Associação Brasileira de Televisão por Assinatura [ABTA] (2014) Dados do setor. Retrieved Oct. 24, 2014, from: http://www.abta.com.br/dados_do_setor.asp.

Antola, Livia; et al. (1984) « Television Flows in Latin America. » Comm Research 11(2): 183-202.

Balio, Tino (1998) « A major presence in all of the world’s important markets. The globalization of Hollywood in the 1990’s. » Contemporary Hollywood Cinema: 58-73.

Borelli, Silvia Helena Simoes; Gabriel, Priolli (dir.) (2000) A deusa ferida : por que a Rede Globo nao e mais a campea absoluta de audiencia, Sao Paulo, Summus Editorial.

Bourdieu, Pierre (1986) The Forms of Capital. Handbook of Theory and Research for the Sociology of Education, J. G. Richardson. New York, Westpint Connecticut, and London, Greenwood Press: 241-258.

Duarte, Luiz Guilherme (2001) Due South: American Television Ventures Into Latin America, Telecommunications, East Lansing, MI, Michigan State University. PhD.

Mattos, Sergio (2002) História da televisão brasileira: uma visão econômica, social e política, Editora Vozes.

Mayer, Vicki (2006) « A vida como ela é/pode ser/deve ser? O programa Aqui Agora e cidadania no Brasil » Intercom – Revista Brasileira de Ciências da Comunicação, 29 (1).

Reis, Raul (1999) « What Prevents Cable TV from Taking off in Brazil? », Journal of Broadcasting & Electronic Media, 43.

Rogers, Everett M.; Antola, Livia (1985) « Telenovelas: A Latin American Success Story. » Journal of Communication, 35(4): 24-35.

Sinclair, John; Straubhaar, Joseph (2013) Television Industries in Latin America, London, BFI/Palgrave.

Soares, Segundo; et al. (2007) « Programas de tranferência condicionada de renda no Brasil, Chile e México: impactos sobre a desigualdade », Brasília: Ipea, 2006. (Texto para Discussão, n. 1.228). Disponível em: http://www.ipea.gov.br/default.jsp

Straubhaar, Joseph (1982) « The Development of the Telenovela as the Paramount Form of Popular Culture in Brazil », Studies in Latin American Popular Culture, 1, 138-150.

Straubhaar, Joseph (1991) « Beyond Media Imperialism: Asymmetrical Interdependence and Cultural Proximity. » Critical Studies in Mass Communication, (8): 39-59.

Straubhaar, Joseph (2007) World Television: From Global to Local, Sage Publications.

Zizola, Francesco (2014) « Brazil’s new middle class. » Retrieved Oct. 23, 2014, 2014, from http://noorimages.com/feature/brazils-new-middle-class/.

Auteurs

Joseph D. Straubhaar

.: Professeur en communications à l’Université du Texas à Austin, nommé sur la chaire pour le centenaire de Amon G. Carter. Il est l’auteur, avec John Sinclair, de Latin American Television Industries, London :BFI, 2013.

Vinicio Sinta

.: Doctorant en journalisme à l’Université du Texas à Austin. Il est diplômé d’un Master en Communications de l’Université Technologique de Monterrey.

Jeremiah Spence

.: Maître de conférences à l’Université Erasmus de Rotterdam. Il est docteur en Communications du département Radio-Télévision-Film de l’Université du Texas à Austin.

Vanessa de Macedo Higgins Joyce

.: Maître de conférences à l’Université du Texas à San Marcos. Docteur en journalisme de l’Université du Texas à Austin, et a obtenu sa licence à l’Université Catholique de São Paulo.

Plan de l’article / Paper outline

Social class and television in Latin America

Quelques instantanés sur le commerce international de biens et services culturels

La Convention et le développement du numérique

Conclusion : la bataille pour la diversité continue

Contact J. Straubhaar

Contact V.Sinta

Contact J. Spence

Contact V. Higgins Joyce